Thai Property Taxes Explained: What You Need To Know

It’s a huge concern that needs to be taken into account when purchasing a property, regardless of whether it’s for investment purposes or otherwise. Property taxes can chip away at your returns on investment, leaving you with a considerable out-of-pocket bill at the end of the financial year.

As an investor renting out property in Thailand, one will also face the additional worry of taxes on one’s rental income. We take a look at Thailand’s property tax structure, highlighting the need-to-knows before you purchase that condominium unit as an individual:

Transparency and no annual property tax

Aside from the unparalleled appreciation in property values and impressive rental yields over the course of the last decade, one factor that entices many foreigners to purchase property in Thailand is its flat tax structure that is void of any hidden costs. Unlike several of its neighbouring countries, Thailand does not charge annual income tax for owning a property, its blanket zero tax policy only kicksin upon sale of the said property.

Tax incurred upon the sale of property

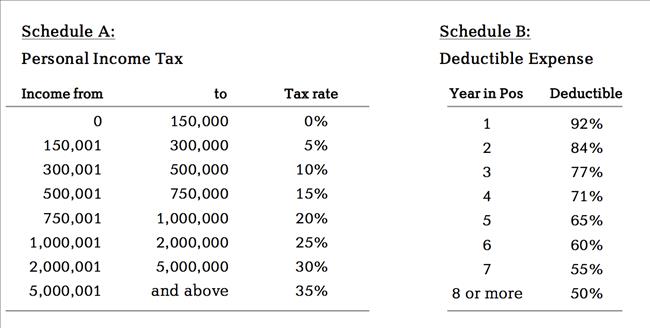

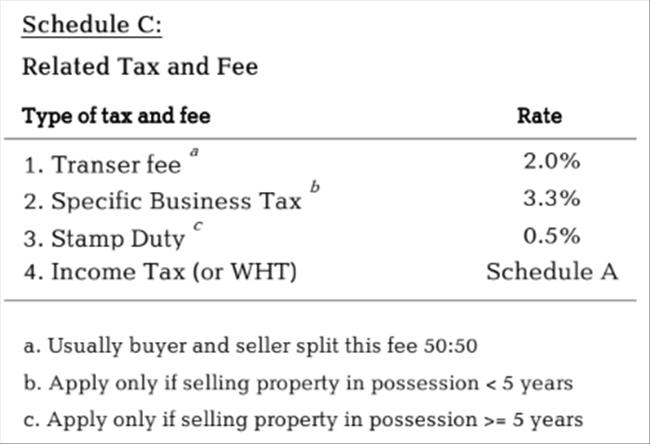

The Thai government imposes a fixed transfer fee of 2% of the sale figure when purchasing or selling a property. This fee is usually shared between the buyer and seller (at 1% each) with responsibility landing on both parties but is negotiable depending on the terms agreed upon. If the property has been owned for equal to or more than five years, a stamp duty of 0.5% is also imposed on the sale.

When it comes to business tax upon the sale of a property, a levy of 3.3% of the registered sale price or appraised value (whichever is higher) is handed over through the sale. This amount comprises of Specific Business Tax (3%) and local tax (0.3%), which is applicable to the sale of immovable property or real estate in a commercial or profitable manner. It should be noted that this tax is only applicable on the first 5 years after ownership of the property. If the property was acquired through inheritance, this figure is waived regardless of the time period that it was owned for.

Property tax upon the sale of a property is payable by sellers based on a withholding tax structure that is calculated progressively based on the sale price or appraisal value (whichever is higher) of the property in question and the duration that the property has been owned for.

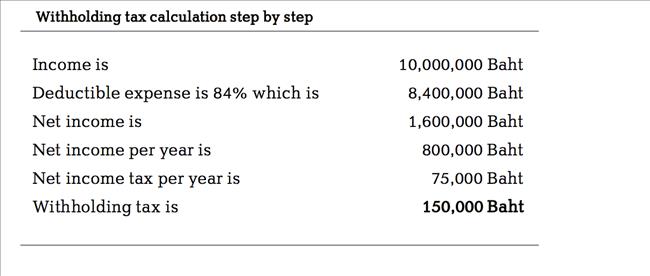

The withholding tax is essentially calculated using selling price as gross income then deducting expense from Schedule B (shown in table below) to get net income. One then divides net income with years in possession to get yearly net income. One can use net income per year to calculate tax income per year from Schedule A. The final step is to multiply tax income per year with years that the property has been in possession to calculate total Withholding tax.

Withholding tax is calculated by using selling price as income then deduct expense from Schedule B to get net income then divide net income with years in possession to get yearly net income. Use net income per year to calculate tax income per year from Schedule A. Final step is multiply tax income per year with years in possession to get Withholding tax.

Let’s take an example of a property that was sold for 10 million Baht and owned for two years. The table below shows the step-by-step calculation process:

Based on the above figures, the total withholding tax for the year will be 150,000 Baht.

Tax incurred on rental income

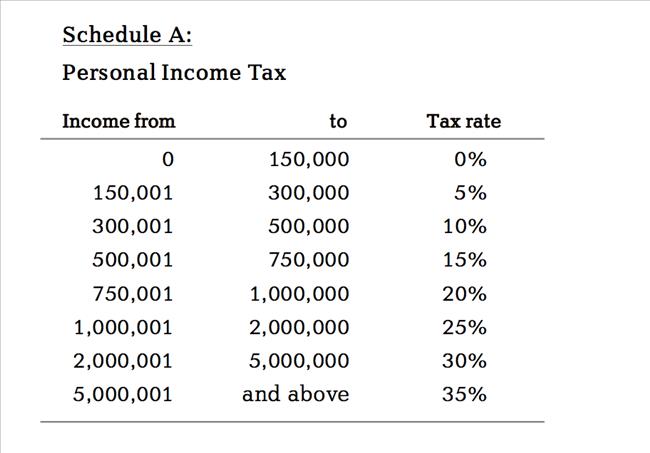

Aside from property tax incurred on the sale of property, investors are usually concerned about the tax structure for rental income. The following table shows the personal income tax rates:

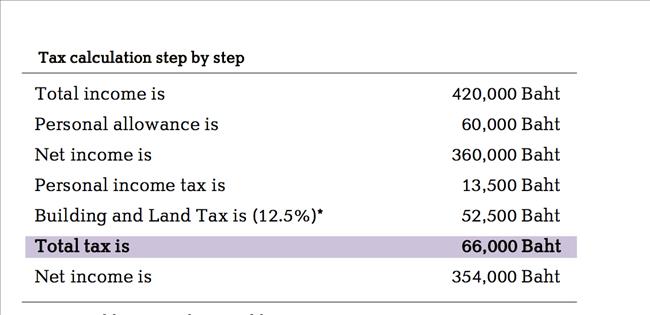

The best way to represent these figures is again by an example. The average monthly rate of a 1 Bedroom in the Thonglor area is 35,000 Baht. Taking the average rental yield to be 5%, the property price will be annual rental income (35,000 Baht X 12 months) divided by rental yield, which equates to 8,400,000 Baht. The table below shows the calculation for annual income tax from the rental property:

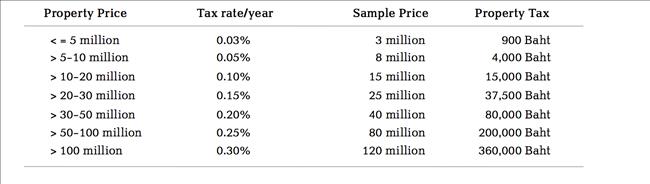

It should be noted that changes in property and land tax of 12.5% will take effect from the beginning of 2019, and will be as follows:

And there we have it, a breakdown of the basic property tax structures in Thailand that investors and owners need to be aware about. When compared to other nations in the region, Thailand offers a favourable structure that ensures that your returns on investments are protected with minimal erosion to capital gains.